Fuel/Petroleum Dyes & Markers Market - Forecast(2025 - 2031)

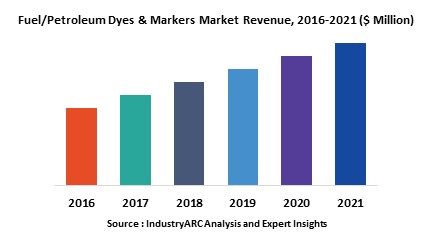

These fuel markings helping the government to raise the revenue, combat smuggling as well as to improve environment. The global fuel petroleum dyes and markers market share worth$1.1B in 2017 and is projected to witness a market growth at CAGR of 4.64% during the forecast period of 2018-2023. Among dyes the florescent dyes generated highest revenue with 465.1M and is estimated to continue the dominance in coming years. North-America hold the largest market share with 28% and generated the highest revenue.

What is Fuel/Petroleum Dyes and Markers Market?

Fuel/petroleum Dyes are colored materials that convey more or less permanent color to other materials such as petroleum product, lubricating oils and gasoline. Fuel and petroleum dyes can also be termed as complex and unsaturated aromatic compounds which have characteristics such as solubility, intense color and substansiveness. Furthermore, Markers are colorless substance added to fuels which can be detected by adding some reagent to formulate color by placing it in spectrophotometer for efficient result. Fuel and Petroleum Dyes market have been segmented into Liquid, powder and solvent dyes on the basis of form.

The market for Fuel and Petroleum Dyes have been further segment into fluorescent dye, alkyl dye, azo dyes and others. Azo dyes can also be termed as red dye is the most popular among other. Red dyes is known for its functionality like more efficient and traceable quality for dyeing. Fuel and petroleum industry analysis states azo dyes will earn massive profit during the forecast period. Solvent soluble dyes are the rapidly growing segment in the fuel and petroleum market primarily for its solubility in organic solvents as well as in hydrocarbons expected to increase growth by the end of 2023.

What are the major applications for fuel/petroleum dyes and markers?

Fuel dyes are most widely been used in oil, wax coloration, fuel grease, and lubricant and many other applications. They are heat stable highly concentrated colorants, which are available in powder, solvent and liquid form, and are soluble in lubricants, polar solvents, and hydrocarbon-based oil. Their high concentration allows the formulator to use minimal amounts of dye thereby causing no change to the product’s original physical characteristics. Moreover, their stability to high heat makes them a good match for lubricants, engine oil, automatic transmission fluid, and grease. Some lubricants are water-based and would require our water-soluble dyes or possibly pigments.

Petroleum dyes applications include heating oil, biodiesel, jet-fuel, fuel additives, gasoline, diesel, and kerosene. Wax applications include candles, shoe polish, coatings, lamp oils, and beeswax.

Market Research and Market Trends of fuel/petroleum dyes and markers

- Red dye is the mostly used fuel as it is helpful in catching theft of thousands of dollars’ worth of diesel from farm fuel tanks everywhere. This has led to the new rural farm watch initiative that identifies stolen fuel with the red dye that turns the fuel into pink.

- Currently, Fluorescent dye is used in the division of surgical oncology. Fluorescence imaging technique helped in removing the cancerous cells during surgery. This new technique is a huge step forward in providing surgeons with an effective tool to fight against cancer. This new technique will expand the market size of fuel and petroleum dye & marker industry.

- Automobile sales and the aerospace sectors have grown with the economic recovery and have thus led to increased fuel consumption. With this the consumption of fuel dyes will drive the market in coming years.

- Market Study on Fuel/Petroleum Dyes & Markers market imparts that improved physical properties of dyes and markers will increase the applications and are satisfying the consumer needs will improve the demand in end user industry segments.

Who are the Major Players in fuel/petroleum dyes and markers market?

The companies referred in the market research report includes Innospec Inc, John Hogg & Co ltd, The dow chemical company, United color manufacturing Co, Authentix Inc.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. Fuel/Petroleum Dyes & Markers Market - Overview

1.1. Definitions and Scope

2. Fuel/Petroleum Dyes & Markers Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Fuel/Petroleum Dyes & Markers Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Fuel/Petroleum Dyes & Markers Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Fuel/Petroleum Dyes & Markers Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Fuel/Petroleum Dyes & Markers Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Fuel/Petroleum Dyes & Markers Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Fuel/Petroleum Dyes & Markers Market – By Type (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Introduction

8.3.2. Fluorescent Dye

8.3.3. Alkyl Dye

8.3.4. Azo Dyes

8.3.5. Other Dye

9. Fuel/Petroleum Dyes & Markers Market – By Form (Market Size -$Million / $Billion)

9.1. Introduction

9.2. Liquid

9.3. Powder

9.4. solvents

10. Fuel/Petroleum Dyes & Markers Market – By color (Market Size -$Million / $Billion)

10.1. Red dye

10.2. Blue dye

10.3. Green dye

10.4. Yellow dye

10.5. Other dyes & markers

11. Fuel/Petroleum Dyes & Markers Market – By application (Market Size -$Million / $Billion)

11.1. Introduction

11.2. Gasoline

11.3. Diesel fuel

11.4. Jet Fuels

11.5. Fuel Oils

11.6. Lubricants

11.7. Oil greases

11.8. Fuel & fuel additives

11.9. Biodiesel

11.10. Lubricant oils

11.11. Transmission and hydraulic fuels

11.12. Greases

11.13. Aerobatic smokes

11.14. Candle wax

11.15. Wood stains

11.16. Others

12. Fuel/Petroleum Dyes & Markers Market – by markers application (Market Size -$Million / $Billion)

12.1. Fraud detection

12.2. Unique identification

12.3. Grade/brand identification

13. Fuel/Petroleum Dyes & Markers – By End Use Industry(Market Size -$Million / $Billion)

13.1. Segment type Size and Market Share Analysis

13.2. Application Revenue and Trends by type of Application

13.3. Application Segment Analysis by Type

13.3.1. Agriculture

13.3.2. Construction

13.3.3. Mining

13.3.4. Marine

13.3.5. Aviation

13.3.6. Power generation

13.3.7. Transportation

14. Fuel/Petroleum Dyes & Markers - By Geography (Market Size -$Million / $Billion)

14.1. Fuel/Petroleum Dyes & Markers Market - North America Segment Research

14.2. North America Market Research (Million / $Billion)

14.2.1. Segment type Size and Market Size Analysis

14.2.2. Revenue and Trends

14.2.3. Application Revenue and Trends by type of Application

14.2.4. Company Revenue and Product Analysis

14.2.5. North America Product type and Application Market Size

14.2.5.1. U.S.

14.2.5.2. Canada

14.2.5.3. Mexico

14.2.5.4. Rest of North America

14.3. Fuel/Petroleum Dyes & Markers - South America Segment Research

14.4. South America Market Research (Market Size -$Million / $Billion)

14.4.1. Segment type Size and Market Size Analysis

14.4.2. Revenue and Trends

14.4.3. Application Revenue and Trends by type of Application

14.4.4. Company Revenue and Product Analysis

14.4.5. South America Product type and Application Market Size

14.4.5.1. Brazil

14.4.5.2. Venezuela

14.4.5.3. Argentina

14.4.5.4. Ecuador

14.4.5.5. Peru

14.4.5.6. Colombia

14.4.5.7. Costa Rica

14.4.5.8. Rest of South America

14.5. Fuel/Petroleum Dyes & Markers - Europe Segment Research

14.6. Europe Market Research (Market Size -$Million / $Billion)

14.6.1. Segment type Size and Market Size Analysis

14.6.2. Revenue and Trends

14.6.3. Application Revenue and Trends by type of Application

14.6.4. Company Revenue and Product Analysis

14.6.5. Europe Segment Product type and Application Market Size

14.6.5.1. U.K

14.6.5.2. Germany

14.6.5.3. Italy

14.6.5.4. France

14.6.5.5. Netherlands

14.6.5.6. Belgium

14.6.5.7. Spain

14.6.5.8. Denmark

14.6.5.9. Rest of Europe

14.7. Fuel/Petroleum Dyes & Markers – APAC Segment Research

14.8. APAC Market Research (Market Size -$Million / $Billion)

14.8.1. Segment type Size and Market Size Analysis

14.8.2. Revenue and Trends

14.8.3. Application Revenue and Trends by type of Application

14.8.4. Company Revenue and Product Analysis

14.8.5. APAC Segment – Product type and Application Market Size

14.8.5.1. China

14.8.5.2. Australia

14.8.5.3. Japan

14.8.5.4. South Korea

14.8.5.5. India

14.8.5.6. Taiwan

14.8.5.7. Malaysia

15. Fuel/Petroleum Dyes & Markers Market - Entropy

15.1. New product launches

15.2. M&A's, collaborations, JVs and partnerships

14. Fuel/Petroleum Dyes & Markers Market – Industry / Segment Competition landscape Premium

14.1. Market Share Analysis

14.1.1. Market Share by Country- Top companies

14.1.2. Market Share by Region- Top 10 companies

14.1.3. Market Share by type of Application – Top 10 companies

14.1.4. Market Share by type of Product / Product category- Top 10 companies

14.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

15. Fuel/Petroleum Dyes & Markers Market – Key Company List by Country Premium

16. Fuel/Petroleum Dyes & Markers Market Company Analysis

16.1. Market Share, Company Revenue, Products, M&A, Developments

16.2. Innospec Inc

16.3. John Hogg & Co ltd

16.4. The dow chemical company

16.5. United color manufacturing Co

16.6. Authentix Inc

16.7. Company 6

16.8. Company 7

16.9. Company 8

16.10. Company 9

16.11. Company 10

16.12. Company 11

16.13. Company 12

16.14. Company 13

16.15. Company 14 and more

"*Financials would be provided on a best efforts basis for private companies"

18. Fuel/Petroleum Dyes & Markers Market -Appendix

18.1. Abbreviations

18.2. Sources

18. Fuel/Petroleum Dyes & Markers Market -Methodology Premium

18.1. Research Methodology

18.1.1. Company Expert Interviews

18.1.2. Industry Databases

18.1.3. Associations

18.1.4. Company News

18.1.5. Company Annual Reports

18.1.6. Application Trends

18.1.7. New Products and Product database

18.1.8. Company Transcripts

18.1.9. R&D Trends

18.1.10. Key Opinion Leaders Interviews

18.1.11. Supply and Demand Trends

LIST OF TABLES

Table 1 Global Fuel / Petroleum Dyes and Markers Market – Pricing Analysis ($Million)

Table 2 Global Fuel / Petroleum Dyes and Markers Market Revenue, By Form , 2014-2020 ($Million)

Table 3 Global Market for Fuel / Petroleum Dyes and Markers, Volume By Form , 2014-2020 (Kilo Tons)Table 4 Global Market for Fuel / Petroleum Dyes and Markers, Revenue By Color , 2014-2020 ($Million)

Table 5 Global Market for Fuel / Petroleum Dyes and Markers, Volume By Color , 2014-2020 (Kilo Tons)

Table 6 Global Market for Fuel / Petroleum Dyes and Markers, Revenue By Type, 2014-2020 ($Million)

Table 7 Global Market for Fuel / Petroleum Dyes and Markers, Volume By Type, 2014-2020 (Kilo Tons)

Table 8 Global Market for Fuel / Petroleum Dyes and Markers, Revenue By Application, 2014-2020 ($Million)

Table 9 Global Market for Fuel / Petroleum Dyes and Markers, Volume By Application, 2014-2020 (Kilo Tons)

Table 10 Global Market for Fuel / Petroleum Dyes and Markers, Revenue By Geography, 2014-2020 ($Million)

Table 11 Global Market for Fuel / Petroleum Dyes and Markers, Volume By Geography, 2014-2020 (Kilo Tons)

Table 12 Global Fluorescent Dye Market Revenue, By Application, 2014-2020 ($Million)

Table 13 Global Fluorescent Dye Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 14 Global Ethyl Dyes Market Revenue, By Application, 2014-2020 ($Million)

Table 15 Global Ethyl Dyes Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 16 Global Azo Dyes Market Revenue, By Application, 2014-2020 ($Million)

Table 17 Global Azo Dyes Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 18 Global Other Market Revenue, By Application, 2014-2020 ($Million)

Table 19 Global Other Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 20 Americas Market for Fuel / Petroleum Dyes and Markers, Revenue By Form , 2014-2020 ($Million)

Table 21 Americas Market for Fuel / Petroleum Dyes and Markers, Volume By Form, 2014-2020 (Kilo Tons)

Table 22 Americas Market for Fuel / Petroleum Dyes and Markers, Revenue By Color , 2014-2020 ($Million)

Table 23 Americas Market for Fuel / Petroleum Dyes and Markers, Volume By Color , 2014-2020 (Kilo Tons)

Table 24 Americas Market for Fuel / Petroleum Dyes and Markers, Revenue By Type, 2014-2020 ($Million)

Table 25 Americas Market for Fuel / Petroleum Dyes and Markers, Volume By Type, 2014-2020 (Kilo Tons)

Table 26 Americas Market for Fuel / Petroleum Dyes and Markers, Revenue By Application, 2014-2020 ($Million)

Table 27 Americas Market for Fuel / Petroleum Dyes and Markers, Volume By Application, 2014-2020 (Kilo Tons)

Table 28 Americas Market for Fuel / Petroleum Dyes and Markers, Revenue By Country, 2014-2020 ($Million)

Table 29 Americas Market for Fuel / Petroleum Dyes and Markers, Volume By Country, 2014-2020 (Kilo Tons)

Table 30 APAC Market for Fuel / Petroleum Dyes and Markers, Revenue By form , 2014-2020 ($Million)

Table 31 APAC Market for Fuel / Petroleum Dyes and Markers, Volume By form , 2014-2020 (Kilo Tons)

Table 32 APAC Market for Fuel / Petroleum Dyes and Markers, Revenue By Color , 2014-2020 ($Million)

Table 33 APAC Market for Fuel / Petroleum Dyes and Markers, Volume By Color , 2014-2020 (Kilo Tons)

Table 34 APAC Market for Fuel / Petroleum Dyes and Markers, Revenue By Type, 2014-2020 ($Million)

Table 35 APAC Market for Fuel / Petroleum Dyes and Markers, Volume By Type, 2014-2020 (Kilo Tons)

Table 36 APAC Market for Fuel / Petroleum Dyes and Markers, Revenue By Application, 2014-2020 ($Million)

Table 37 APAC Market for Fuel / Petroleum Dyes and Markers, Volume By Application, 2014-2020 (Kilo Tons)

Table 38 APAC Market for Fuel / Petroleum Dyes and Markers, Revenue By Country, 2014-2020 ($Million)

Table 39 APAC Market for Fuel / Petroleum Dyes and Markers, Volume By Country, 2014-2020 (Kilo Tons)

Table 40 Europe Market for Fuel / Petroleum Dyes and Markers, Revenue By form , 2014-2020 ($Million)

Table 41 Europe Market for Fuel / Petroleum Dyes and Markers, Volume By form , 2014-2020 (Kilo Tons)

Table 42 Europe Market for Fuel / Petroleum Dyes and Markers, Revenue By Color , 2014-2020 ($Million)

Table 43 Europe Market for Fuel / Petroleum Dyes and Markers, Volume By Color , 2014-2020 (Kilo Tons)

Table 44 Europe Market for Fuel / Petroleum Dyes and Markers, Revenue By Type, 2014-2020 ($Million)

Table 45 Europe Market for Fuel / Petroleum Dyes and Markers, Volume By Type, 2014-2020 (Kilo Tons)

Table 46 Europe Market for Fuel / Petroleum Dyes and Markers, Revenue By Application, 2014-2020 ($Million)

Table 47 Europe Market for Fuel / Petroleum Dyes and Markers, Volume By Application, 2014-2020 (Kilo Tons)

Table 48 Europe Market for Fuel / Petroleum Dyes and Markers, Revenue By Country, 2014-2020 ($Million)

Table 49 Europe Market for Fuel / Petroleum Dyes and Markers, Volume By Country, 2014-2020 (Kilo Tons)

Table 50 RoW Market for Fuel / Petroleum Dyes and Markers, Revenue By form , 2014-2020 ($Million)

Table 51 RoW Market for Fuel / Petroleum Dyes and Markers, Volume By form , 2014-2020 (Kilo Tons)

Table 52 RoW Market for Fuel / Petroleum Dyes and Markers, Revenue By Color , 2014-2020 ($Million)

Table 53 RoW Market for Fuel / Petroleum Dyes and Markers, Volume By Color , 2014-2020 (Kilo Tons)

Table 54 RoW Market for Fuel / Petroleum Dyes and Markers, Revenue By Type, 2014-2020 ($Million)

Table 55 RoW Market for Fuel / Petroleum Dyes and Markers, Volume By Type, 2014-2020 (Kilo Tons)

Table 56 RoW Market for Fuel / Petroleum Dyes and Markers, Revenue By Application, 2014-2020 ($Million)

Table 57 RoW Market for Fuel / Petroleum Dyes and Markers, Volume By Application, 2014-2020 (Kilo Tons)

Table 58 RoW Market for Fuel / Petroleum Dyes and Markers, Revenue By Country, 2014-2020 ($Million)

Table 59 RoW Market for Fuel / Petroleum Dyes and Markers, Volume By Country, 2014-2020 (Kilo Tons)

Table 60 Global Gasoline Market Revenue, By form, 2014-2020 ($Million)

Table 61 Global Gasoline Market Volume, By form, 2014-2020 (Kilo Tons)

Table 62 Global Diesel Market Revenue, By form, 2014-2020 ($Million)

Table 63 Global Diesel Market Volume, By form, 2014-2020 (Kilo Tons)

Table 64 Global Aviation Fuels Market Revenue, By form, 2014-2020 ($Million)

Table 65 Global Aviation Fuels Market Volume, By form, 2014-2020 (Kilo Tons)

Table 66 Global Marine Fuels and fats Market Revenue, By form, 2014-2020 ($Million)

Table 67 Global Marine Fuels and fats Market Volume, By form, 2014-2020 (Kilo Tons)

Table 68 Global Other Market Revenue, By form, 2014-2020 ($Million)

Table 69 Global Other Market Volume, By form, 2014-2020 (Kilo Tons)

Table 70 M&A, Product Launches, 2010-2015

LIST OF FIGURES

Figure 1 Global Fuel / Petroleum Dyes and Markers Market – Value Chain Analysis

Figure 2 Global Market for Fuel / Petroleum Dyes and Markers – Pricing Analysis, By Type, By Application, 2014 ($/KT)Figure 3 Global Market for Fuel / Petroleum Dyes and Markers life cycle, 2014-2020

Figure 4 Global Market for Fuel / Petroleum Dyes and Markers, By Geography, 2014 - 2020 ($Million)

Figure 5 Segmentation of Global Market for Fuel / Petroleum Dyes and Markers

Figure 6 Global Market for Fuel / Petroleum Dyes and Markers Competitive Share Analysis, 2014 (%)

Figure 7 Global Market for Fuel / Petroleum Dyes and Markers, Share By form, 2014 (%)

Figure 8 Global Market for Fuel / Petroleum Dyes and Markers, Share By Color, 2014 (%)

Figure 9 Global Market for Fuel / Petroleum Dyes and Markers, Share By Type, 2014 (%)

Figure 10 Global Market for Fuel / Petroleum Dyes and Markers, Share By Application, 2014 (%)

Figure 11 Global Market for Fuel / Petroleum Dyes and Markers, Share By Geography, 2014 (%)

Figure 12 Americas Market for Fuel / Petroleum Dyes and Markers, Share By Country, 2014 (%)

Figure 13 Europe Market for Fuel / Petroleum Dyes and Markers, Share By Country, 2014 (%)

Figure 14 APAC Market for Fuel / Petroleum Dyes and Markers, Share By Country, 2014 (%)

Figure 15 RoW Market for Fuel / Petroleum Dyes and Markers, Share By Country, 2014 (%)

Figure 16 Global Fuel / Petroleum Dyes and Markers Market Recent Developments, By Year, 2012-2015

Email

Email Print

Print