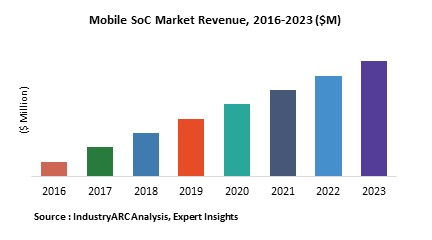

The Mobile SoC Market size is estimated to reach $2393.4 Million by 2030, growing at a CAGR of 15.9% during the forecast period 2024-2030.

There are various reasons for the growth in Mobile SOC’s such as the advancement in technology, the growing demand for smartphones and tablets and the decreasing demand for personal computers and laptops.

What are Mobile SOC’s?

A mobile SOC is an integrated circuit that assimilates all the different components of a mobile. There are various manufacturers of SOC’s, and hence these SOC’s may differ by combinations of components to fit the requirements. These SOC’s may contain different combinations of components, as each manufacturer will attempt to offer a unique selling proposition to the market.

What are the applications of Mobile SOC?

A mobile SOC can be used in various devices including smartphones and portable navigation devices.

These SOC’s have different technologies with 14nm being the latest addition, to the existing 12nm and 10nm models and, currently some companies aiming to launch 7nm technology in the near future.

Each SOC may have a different combination of components. All SOC’s contain a microprocessor, however some may contain an ASIC (application specific integrated circuit), a digital circuit, cellular radios, audio and video recorders, etc.

Market Research & Market Trends:

- Micron, one of the largest chip manufacturers is cut off from the China market, and this will reduce the chip supply in the Chinese market and affect the dependent industries. More companies will seek patents in order to gain control of markets.

- Qualcomm and Broadcomm have not gone through with the merger as major chip manufacturers are considering purchasing local manufacturers with a view to enter new markets. We may come across more mergers and new products when such mergers do take place.

- New SOCs will be launched in the market with 7nm technology. The SOC’s are getting smaller and more powerful every few years and we may see further sizing changes.

- Samsung, which now uses in-house chips, will team up with ARM to develop chips that are faster than any other options in the market. More mobile manufacturers are beginning to develop chips on their own as they can enter a mature product market, and expand their business.

Who are the key players in the Mobile SoC market?

The key players in the mobile SOC market are MediaTek, Qualcomm, Apple, Actions Semiconductor Ltd., Allwinner Technology, Samsung, Huawei, Intel and various other companies.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2024-2030.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

For more Electronics related reports, please click here

1. Mobile SoC Market - Overview

1.1. Definitions and Scope

2. Mobile SoC Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Mobile SoC Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Mobile SoC Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Mobile SoC Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Mobile SoC Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Mobile SoC Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Mobile SoC Market – By Utilization (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Introduction

8.3.2. Dual Core

8.3.3. Quad Core

8.3.4. Octa Core

8.3.5. Others

9. Mobile SoC Market – By Technology (Market Size -$Million / $Billion)

9.1. 14nm

9.2. 12nm

9.3. 10nm

10. Mobile SoC Market – By Component (Market Size -$Million / $Billion)

10.1. Microprocessor

10.2. Firmware

10.3. Digital & Analog Circuit

10.4. Memory

10.5. Display

10.6. Timers

10.7. ASIC

10.8. Others

11. Mobile SoC Market – By Application (Market Size -$Million / $Billion)

11.1. Introduction

11.2. Mobile Phones

11.3. Portable Navigation Devices

11.4. Others

12. Mobile SoC - By Geography (Market Size -$Million / $Billion)

12.1. Mobile SoC Market - North America Segment Research

12.2. North America Market Research (Million / $Billion)

12.2.1. Segment type Size and Market Size Analysis

12.2.2. Revenue and Trends

12.2.3. Application Revenue and Trends by type of Application

12.2.4. Company Revenue and Product Analysis

12.2.5. North America Product type and Application Market Size

12.2.5.1. U.S.

12.2.5.2. Canada

12.2.5.3. Mexico

12.2.5.4. Rest of North America

12.3. Mobile SoC - South America Segment Research

12.4. South America Market Research (Market Size -$Million / $Billion)

12.4.1. Segment type Size and Market Size Analysis

12.4.2. Revenue and Trends

12.4.3. Application Revenue and Trends by type of Application

12.4.4. Company Revenue and Product Analysis

12.4.5. South America Product type and Application Market Size

12.4.5.1. Brazil

12.4.5.2. Venezuela

12.4.5.3. Argentina

12.4.5.4. Ecuador

12.4.5.5. Peru

12.4.5.6. Colombia

12.4.5.7. Costa Rica

12.4.5.8. Rest of South America

12.5. Mobile SoC - Europe Segment Research

12.6. Europe Market Research (Market Size -$Million / $Billion)

12.6.1. Segment type Size and Market Size Analysis

12.6.2. Revenue and Trends

12.6.3. Application Revenue and Trends by type of Application

12.6.4. Company Revenue and Product Analysis

12.6.5. Europe Segment Product type and Application Market Size

12.6.5.1. U.K

12.6.5.2. Germany

12.6.5.3. Italy

12.6.5.4. France

12.6.5.5. Netherlands

12.6.5.6. Belgium

12.6.5.7. Spain

12.6.5.8. Denmark

12.6.5.9. Rest of Europe

12.7. Mobile SoC – APAC Segment Research

12.8. APAC Market Research (Market Size -$Million / $Billion)

12.8.1. Segment type Size and Market Size Analysis

12.8.2. Revenue and Trends

12.8.3. Application Revenue and Trends by type of Application

12.8.4. Company Revenue and Product Analysis

12.8.5. APAC Segment – Product type and Application Market Size

12.8.5.1. China

12.8.5.2. Australia

12.8.5.3. Japan

12.8.5.4. South Korea

12.8.5.5. India

12.8.5.6. Taiwan

12.8.5.7. Malaysia

13. Mobile SoC Market - Entropy

13.1. New product launches

13.2. M&A's, collaborations, JVs and partnerships

14. Mobile SoC Market – Industry / Segment Competition landscape Premium

14.1. Market Share Analysis

14.1.1. Market Share by Country- Top companies

14.1.2. Market Share by Region- Top 10 companies

14.1.3. Market Share by type of Application – Top 10 companies

14.1.4. Market Share by type of Product / Product category- Top 10 companies

14.1.5. Market Share at global level- Top 10 companies

14.1.6. Best Practises for companies

15. Mobile SoC Market – Key Company List by Country Premium

16. Mobile SoC Market Company Analysis

16.1. Market Share, Company Revenue, Products, M&A, Developments

16.2. MediaTek

16.3. Qualcomm

16.4. Apple

16.5. Allwinner Technology

16.6. Samsung

16.7. Huawei

16.8. Intel

16.9. Company 8

16.10. Company 9

16.11. Company 10 and more

"*Financials would be provided on a best efforts basis for private companies"

17. Mobile SoC Market -Appendix

17.1. Abbreviations

17.2. Sources

18. Mobile SoC Market -Methodology Premium

18.1. Research Methodology

18.1.1. Company Expert Interviews

18.1.2. Industry Databases

18.1.3. Associations

18.1.4. Company News

18.1.5. Company Annual Reports

18.1.6. Application Trends

18.1.7. New Products and Product database

18.1.8. Company Transcripts

18.1.9. R&D Trends

18.1.10. Key Opinion Leaders Interviews

18.1.11. Supply and Demand Trends

LIST OF TABLES

Table 1: MOBILE SOC HARDWARE/ FIRMWARE ENGINEERING – BY TYPE

Table 2: FOLLOWING ARE THE LIST MOBILE SOCS THAT ARE USED BY DIFFERENT SMARTPHONE MANUFACTURERS

Table 3: ANALYSIS OF MSOC USED IN PHONES AVAILABLE IN THE MARKET

Table 4: ANALYSIS OF MSOC USED IN UPCOMING PHONES

Table 5: TSMC - DESIGN FOR MANUFACTURING (DFM) OFFERINGS

Table 6: COMPARISON OF DIFFERENT IP FORMATS

Table 7: EXAMPLES OF IP

Table 8: IP SELECTION

Table 9: APPROACHES TO 3RD PARTY IP USE

Table 10: BEST PRACTICES FOR IP SELECTION ACCORDING TO MEDIATEK

Table 11: BEST PRACTICES FOR SOFT IP:

Table 12: BEST PRACTICES FOR STRUCTURED-ASIC DESIGN FOLLOWED BY QUALCOMM:

Table 13: THE FIRM IP BEST PRACTICES:

Table 14: COMPARISON OF APPROACHES FOR OPTIMIZING HYBRID SOC SYSTEMS

Table 15: TYPES OF PROTOTYPING THAT HELP DEVELOPERS TO REDUCE IMPACT OF DEPENDENCIES

Table 16: MAJOR FACTORS IN SYSTEM DOMAIN INTEGRATION

Table 17: SYSTEM DOMAIN DEBUG BEST PRACTICES

Table 18: RTL DESIGN BEST PRACTICES

Table 19: STRUCTURAL DESIGN BEST PRACTICES

Table 20: PHYSICAL DESIGN TESTING

Table 21: THE FIVE PHASE DESIGN FLOW COMPRISE OF

Table 22: HARDWARE INTEGRATION/ FOUNDRY BEST PRACTICES FOR APPLE

Table 23: VERIFICATION BEST PRACTICES FOLLOWED BY SAMSUNG (OLD)

Table 24: VERIFICATION BEST PRACTICES FOLLOWED BY QUALCOMM

Table 25: SOC TEST BEST PRACTICES FOLLOWED BY SAMSUNG

Table 26: SNAPDRAGON 800 SERIES, BY SPECIFICATIONS

Table 27: SNAPDRAGON 600 SERIES, BY SPECIFICATIONS

Table 28: SAMSUNG MODEL, BY SPECIFICATIONS

Table 29: APPLE MODEL, BY SPECIFICATIONS

Table 30: TYPICAL DYNAMIC INSTRUCTION USAGE

Table 31: HIGHLIGHT OF THE LAST DECADE OF ARM DEVELOPMENT

Table 32: STEPS FOR OPTIMIZING FLOOR PLANS

Table 33: AREA COMPARISON FOR DIFFERENT MEMORY TECHNOLOGY

Table 34: MEMORY SPEED COMPARISON FOR MAJOR SOCS

Table 35: I/O SPECIFICATIONS FOR INTEL 82801 FR I/O CONTROLLERS

Table 36: COMMON I/O DESIGN STRATEGIES FOR HIGH-SPEED INTERFACE

Table 37: THE TABLE BELOW SHOWS THE POTENTIAL FOR POWER SAVING IN CONTEXT TO THE DESIGN FLOW OF SOC

Table 38: IMPACT OF THE VARIOUS TECHNIQUES ON POWER TYPES TARGETED AND VERIFICATION

Table 39: IMPACT OF THE VARIOUS TECHNIQUES ON POWER TYPES TARGETED AND VERIFICATION

Table 40: MAJOR SENSORS USED IN MAJOR SOCS

Table 41: DISPLAY USED IN MAJOR SOCS

Table 42: MAJOR AUDIO VIDEO CODECS USED IN MAJOR SOCS

Table 43: BEST PRACTICES OF BSP DEVELOPMENT FOLLOWED BY TEXAS INSTRUMENTS

Table 44: FEATURES OF QUALCOMM’S BSP

Table 45: MAJOR COMPONENTS USED IN SOCS

Table 46: FOLLOWING ARE SOME TOOLS WITH DESCRIPTION OFFERED BY SYNOPSYS

Table 47: LIST OF PRIMARY FEATURES IN QUALCOMM 820

Table 48: LIST OF PRIMARY FEATURES IN QUALCOMM 810

Table 49: LIST OF PRIMARY FEATURES IN APPLE A9

Table 50: COMPARISON OF APPLE A9 AND APPLE A8 SOCS

Table 51: APPLE SOC EVOLUTION (COMPARING LAST FEW PRODUCTS)

Table 52: LIST OF PRIMARY FEATURES IN SAMSUNG EXYNOS 8890

Table 53: LIST OF PRIMARY FEATURES IN SAMSUNG EXYNOS 7420

Table 54: BLOCK & DIE SIZES (MM²)

Table 55: FOLLOWING ARE THE ABBREVIATIONS USED IN THE MOBILE SOC REPORT

Table 56: LIST OF UNIVERSITY DOCUMENTS

Table 57: LIST OF BOOKS

Table 58: KEY POINTERS FROM THE INDUSTRY EXPERTS

LIST OF FIGURES

Figure 1: MOBILE SOC – SIMPLIFIED VALUE CHAIN

Figure 2: PROCESSOR PLANNING TO PRODUCTION PHASE

Figure 3: MOBILE SOC PRODUCT LIFECYCLE MANAGEMENT – BY APPLICATIONS AND PROCESSES

Figure 4: MOBILE SOC DEVELOPMENT TOOLS

Figure 5: DESIGN AND MANUFACTURING FLOW FOR SOC

Figure 6: GROWTH OF MULTI-PATTERNING TECHNIQUES BY TECHNOLOGY NODE

Figure 7: TIME SPENT IN DESIGN PHASE

Figure 8: TOP-DOWN DESIGN FLOW AND BOTTOM-UP DESIGN FLOW

Figure 9: TRADITIONAL WATERFALL DESIGN FLOW

Figure 10: SPIRAL SOC DESIGN FLOW

Figure 11: FOUNDRY PHASE PROCEDURE

Figure 12: TSMC QUALITY MANAGEMENT SYSTEM

Figure 13: SAMSUNG’S ORGANIZATIONAL STRUCTURE FOR COMPLIANCE MANAGEMENT

Figure 14: PROCESSING ENGINES IN A SNAPDRAGON SOC

Figure 15: STRATEGY FOLLOWED BY THE KEY PLAYERS IN SOC (%)

Figure 16: IP QUALIFICATION PROCESS

Figure 17: RELATIVE COST OF FIXING IP WITH DESIGN CYCLE

Figure 18: VERIFICATION PROCESS

Figure 19: DISTRIBUTED TOOLS INVOCATION WITH TRMS

Figure 20: COST MANAGEMENT BASICALLY HAS FOUR PROMINENT STEPS

Figure 21: COST ANALYSIS OF SOC DESIGN FOR 16/14NM

Figure 22: BREAKEVEN COST SHIPMENTS FOR $20 SOC, BY NODE PROCESS, MILLION UNITS

Figure 23: SUMMARY OF TEST REQUIREMENTS

Figure 24: VERIFICATION FLOW

Figure 25: PROCESS TECHNIQUES (VERIFICATION OF DESIGN DEVELOPMENTS)

Figure 26: FACILITY MANAGEMENT – ITS APPLICATIONS

Figure 27: COMPARISON OF FEATURES IN DIFFERENT TECHNOLOGIES

Figure 28: MEMORY USAGE IN SOCS

Figure 29: POWER OPTIMIZATION POTENTIAL AT DIVERSE LEVEL OF DESIGN ABSTRACTION

Figure 30: THE FIGURE BELOW SHOWS THE POWER OPTIMIZATION TECHNIQUES WITH RESPECT TO STATIC AND DYNAMIC POWER

Figure 31: TYPES OF SENSORS OPTED IN DIFFERENT SMARTPHONES

Figure 32: ARCHITECTURE OF GPIO

Figure 33: TYPICAL EDA FLOW

Figure 34: COST ANALYSIS OF SOC WITH IMPLEMENTATION OF NEW TECHNOLOGIES

Figure 35: LINKS BETWEEN THE MAIN DEVELOPMENT PHASES AND THE USE OF TLM VIRTUAL PLATFORM

Figure 36: COST ANALYSIS OF DEBUG IN THE DESIGN PROCESS

Figure 37: COMPARISON OF APPLE SOCS CPU FREQUENCY

Figure 38: TOTAL A9 CHIP MANUFACTURER DISTRIBUTION

Figure 39: FOLLOWING TOP 10 PERFORMANCE CHIPS FOR Q1 2015

Figure 40: GPU PERFORMANCE COMPARISON, ANTUTU BENCHMARK, Q1, 2015

Email

Email Print

Print